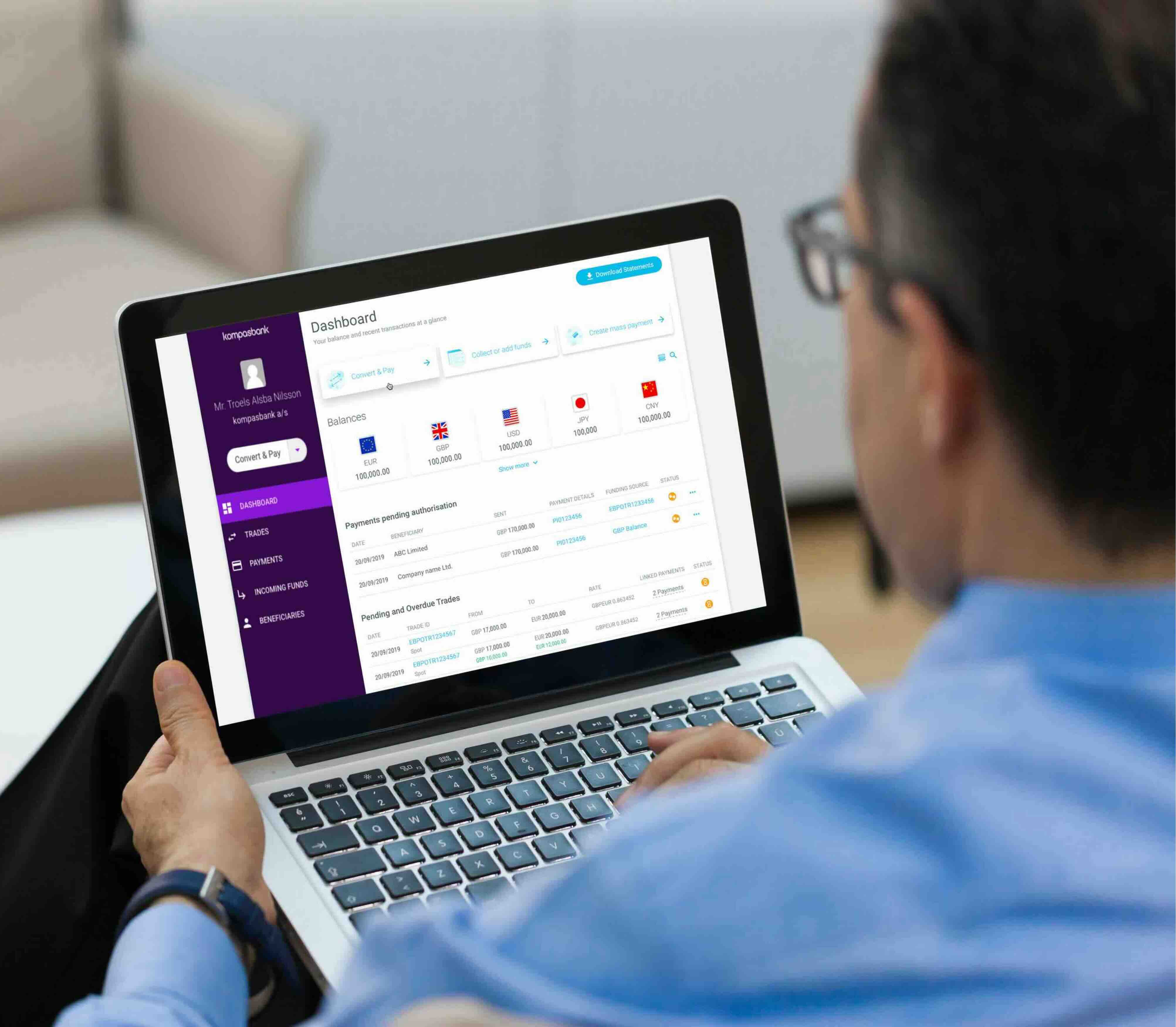

Gain access to an intuitive and modern platform that makes it easy to perform currency exchanges and online payments. You will have access to more than 100 different currencies at very advantageous rates.

If you have suppliers abroad or sell to foreign customers, you have probably experienced that it can be expensive to exchange and pay from DKK to local currency and vice versa.

On our forex trading and payments platform, you can access favorable exchange rates, easily create local and foreign accounts, and a unique opportunity to easily send and receive money globally.

Gain access to an intuitive and modern platform that makes it easy to perform currency exchanges and online payments. You will have access to more than 100 different currencies at very advantageous rates.

Pay and receive like a local

Pay and receive like a local

With a foreign currency account, you can pay and receive money like a local – without needing multiple banks or a local presence – helping you reduce hassle and costs for your business and your suppliers.

Save money on currency exchanges and international payments with favorable exchange rates. Avoid high fees and extra costs.

e-commerce & FX

Do you sell through Amazon, Shopify, or other international e-commerce platforms? Then you know how complicated and costly it can be to access your payments.

On our foreign exchange trading platform, you get access to global multi-currency accounts, enabling you to receive payouts from your international webshop smarter, faster, and cheaper.

On our foreign exchange trading platform, you get access to multi-currency accounts, enabling you to receive payouts from your international webshop smarter, faster, and cheaper.

Avoid high fees and delays in withdrawals and get faster access to your money.

Compatible with Amazon, Shopify and other marketplaces.

Currency hedging

Exchange rates fluctuate constantly, and this can have a direct impact on your company’s bottom line. If you trade in foreign currencies without a clear currency policy and hedging strategy, unexpected exchange rate fluctuations can quickly harm your earnings and financial results.

That’s why it’s crucial to identify and manage the risks associated with currency trading continuously. A targeted and active approach to currency risk management provides financial security and creates a solid foundation for better budgeting, planning, and decision-making.

At kompasbank, we help you develop a tailored currency policy that provides clarity, protects against unforeseen fluctuations, and supports your company’s overall strategy.

In the past, I was basically gambling a little. I’d think about whether I should pay an invoice today or in five days, and when it made the most sense in terms of the exchange rate. I don’t have to do that anymore with kompasbanks FX platform.

Below, you can see how our new currency platform helps strengthen Danish SMEs' competitiveness and negotiating power and makes it easier and cheaper for them to do business with customers and suppliers abroad.

A Danish SME sells food products to several African countries but has been limited by local banks that often lack USD for their customers.

With kompasbanks' FX solution, the company can receive payments in local currencies, removing a significant trade barrier. This is expected to double sales to Africa.

A Danish SME runs a Shopify webshop and sells to countries worldwide, but currency exchange to DKK or EUR can be very expensive.

Since kompasbank's currency solution is fully integrated with Shopify, the company can transfer revenue to a local account and exchange it into any currency—at a significantly better rate. The result? Lower costs and greater savings.

A Danish SME buys goods in several Asian countries and typically pays one week before shipment to ensure that the supplier receives the payment.

With kompasbank’s FX solution, the company can pay its suppliers in local currency directly from a local account – faster and with extended liquidity.

Guide to currency trading

Does your business deal with foreign suppliers or customers? Then, you are familiar with the costs and challenges that arise when you pay or receive payments in a currency other than Danish kroner.

You can make smarter financial decisions and minimize costs with a good understanding of currency exchange and international payments.

In our mini-guide, you will find tips to avoid expensive fees and make your international transactions more efficient.

Get a free introduction

Book a meeting with one of our advisors and gain insight into how we can help your business save time and money when trading with foreign partners.

Agenda for the meeting:

Mutual presentation

Your current setup for currency trading

Introduction to our FX trading solution

Opportunities for cooperation

Currency exchange

Timing of fund transfer

If you don't have a local account in the desired currency, it may take longer for the money to arrive, which can affect your business's liquidity.

High costs and spreads

When you exchange currency, a currency margin or a 'spead' is added to the base rate.

Slow services

Many traditional banks lack self-service options for currency exchange. This can be inconvenient and slow

Limited currency selection

Many banks only offer a limited selection of currencies, which may not meet your needs.

We have entered into a partnership with a leading British fintech company, Ebury, which makes it easy for small and medium-sized companies to trade abroad. Ebury specializes in foreign exchange services, international payments, collections, risk management, etc., and thus offers most of the financial services a company needs in connection with global trade.

Ebury offers currency exchange in over 140 currencies and serves over 50,000 companies globally. Founded in 2009, it has offices in more than 25 countries and over 1,700 employees.

Since its establishment in 2009, Ebury has received over 20 international awards, including 'Financial Times 1000 Europe's fastest-growing companies 2020' and 'The Sunday Times Tech Track 100', highlighting Ebury as one of the leading fintech companies in Europe.

Get more information about the benefits, you can access through our partnership with Ebury.

Stay updated on the latest news, tips, and products from kompasbank, which can inspire and help you run your business more efficiently or secure a good interest rate on your personal savings.