05/27/2022

Get Denmark's best interest rate on your savings with KOMPAS PLUS

4 percent! That’s how much Danes can earn on their savings if they deposit money with Denmark’s newest bank, kompasbank, starting today. According to Mybanker, this rate is more than double what other Danish banks offer.

Just as negative interest rates are being phased out, kompasbank — never having had negative rates — surpasses all expectations by offering Danish savers a 4% interest rate on a savings account with a 36-month term.

Mybanker.dk’s latest overview confirms that kompasbank is the leading bank in Denmark for offering the best rate on savings. Even with a binding period of just 12 months, no other bank can match kompasbank’s 2% interest rate (source: Mybanker).

This rate increase follows recent hikes by the European Central Bank (ECB), the National Bank of Denmark, and the Federal Reserve (FED).

“The high inflation and market uncertainty have caused concern among Danes, leading to increased demand for a reliable, straightforward, and secure place for their savings. That’s why we’ve revitalized the savings account with a compelling interest rate, making it worthwhile to keep funds in the bank,” says Michael Hurup Andersen, co-CEO and founder of kompasbank.

kompasbank, unique among Danish banks for never having implemented negative interest rates on private deposit accounts, is now offering a 4% interest rate on deposits with a 36-month term. This represents a significant increase from the previous rate.

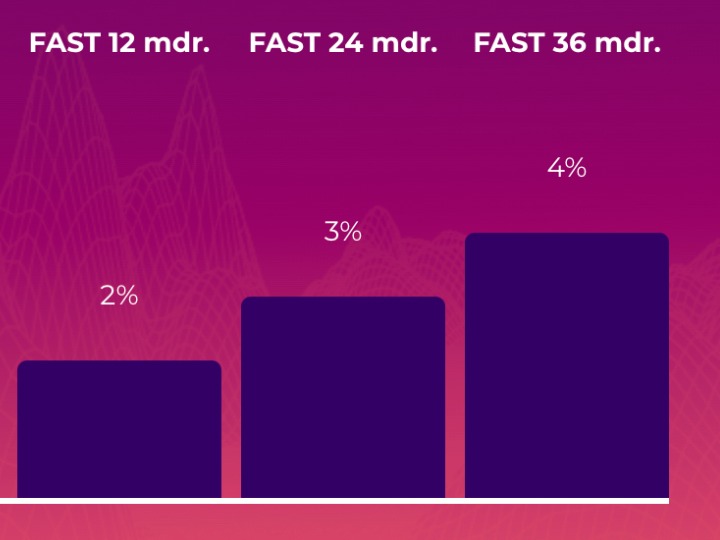

kompasbank is currently accepting new accounts for private individuals with the following interest rates as of September 26, 2022:

2% on deposits with a 12-month term (previously 1.25%)

3% on deposits with a 24-month term (previously 1.5%)

4% on deposits with a 36-month term (previously 2%)

There are no fees with us – only if you choose to withdraw your deposit early, we apply the following penalties:

Remaining term up to 12 months – 1% penalty

Remaining term between 12-24 months – 2% penalty

Remaining term over 24 months – 3% penalty

Notice period shorter than 31 days – 1% penalty (applies only to KOMPAS VARIABLE)

For further information, please contact

Kasper Kankelborg

Head of Communication & Marketing